Unlocking the Secrets of the Cryptocurrency Market: Understanding Cryptocurrencies, TVL, RSI, and Trading Volume

The world of cryptocurrencies has been booming over the past few years as more and more people have delved into the world of digital currencies. But amidst all the hype, it is essential to understand the fundamentals that drive the market forward. In this article, we will delve into three critical metrics: cryptocurrency (the cryptocurrency market in general), total value locked (TVL), relative strength index (RSI), and trading volume.

Cryptocurrencies: The Ongoing Global Phenomenon

The cryptocurrency market is a diverse and ever-evolving landscape, with thousands of cryptocurrencies vying for attention. According to Coindesk's 2022 State of Crypto Report, the top 10 cryptocurrencies by market cap account for over 70% of the total market value.

Total Value Locked (TVL): The Reserve of Digital Currency

Total Value Locked refers to the collective amount of money locked in cryptocurrency wallets across all exchanges. This metric provides valuable insights into the overall adoption and usage of digital currencies. As reported by CoinGecko, TVL has been steadily increasing over the past year, with a significant spike during the 2021 bull run.

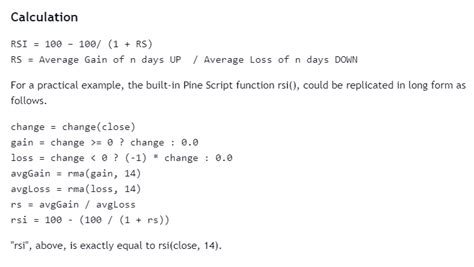

Relative Strength Index (RSI): A Measure of Market Sentiment

The Relative Strength Index is a technical analysis tool used to identify market trends and sentiment in various markets. Developed by J. Welles Wilder, the RSI measures the magnitude of recent price changes to determine overbought or oversold conditions. By monitoring the 14-period moving average (MA) and Bollinger Bands, traders can gauge the strength and momentum of a market.

Trading Volume: The Lifeblood of the Market

Trading volume is the number of transactions executed on a given exchange. Understanding trading volume is essential as it directly impacts prices, sentiment, and market dynamics. High trading volume indicates increased buying and selling activity, which can lead to price volatility and potentially lucrative profits.

Intersecting Trends: Cryptocurrency, TVL, RSI, and Trading Volume

As the cryptocurrency market continues to evolve, these metrics provide a unique window into its inner workings. By analyzing the relationships between them, traders and investors can gain valuable insights into market trends and make informed decisions.

Cryptocurrency: An uptrend is likely to be accompanied by an increase in TVL, as more people join the market and begin investing.

TVL: When RSI levels approach 70%, this could indicate a significant increase in trading volume, which could lead to higher prices.

RSI:

When the RSI falls below 30, it could indicate a strong bullish trend, but if it rises above 80, it could be an overbought condition.

Conclusion

The intersection of Crypto, TVL, RSI, and trading volume provides a comprehensive understanding of the cryptocurrency market dynamics. By monitoring these metrics, traders and investors can make more informed decisions and navigate the changing digital currency landscape. As the cryptocurrency space continues to expand and evolve, it is essential to remain vigilant and adapt to new trends and developments.

Recommendations:

- Stay up to date with the latest market news and trends.

- Use technical analysis tools such as the RSI to gauge market sentiment.

- Monitor trading volume to identify potential buy or sell signals.

By knowing cryptocurrencies, TVL, RSI, and trading volume, you can uncover the secrets of the cryptocurrency market and make informed decisions as you continue to shape the future.