"Navigating the Complex Web of Cryptocurrencies: A Holistic Approach to Supply Chain Efficiency and Risk Mitigation"

The increasing adoption of cryptocurrency has introduced new challenges for businesses involved in global trade. In today's interconnected economy, secure supply chains are crucial for companies seeking to stay competitive and mitigate risks associated with decentralized transactions.

Cryptocurrencies have transformed the way goods are traded and stored, but this shift also brings new complexities. As cryptocurrencies like Bitcoin and Ethereum gain popularity, traditional payment systems struggle to keep pace. Companies must adapt their trading strategies to accommodate these changes, while ensuring secure and efficient supply chain management.

Supply Chain Optimization

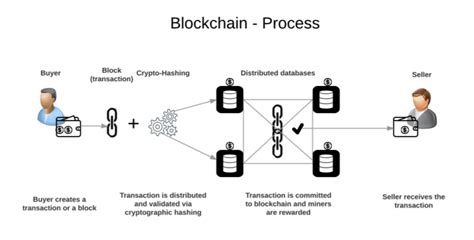

One key area of focus is supply chain optimization. This involves streamlining processes from procurement to delivery, reducing waste, and increasing the accuracy of inventory tracking. By implementing smart contracts and blockchain technology, companies can:

Improve visibility

: Track goods in real-time, enabling faster decision-making and reduced errors.

Enhance transparency: Verify the origin and provenance of goods, reducing the risk of counterfeiting or tampering.

Increase efficiency: Automate manual processes, such as invoicing and shipping documentation.

To achieve these goals, companies must invest in technology and process improvements that support decentralized transactions. This includes:

Blockchain-based platforms

: Leverage blockchain networks to create secure, transparent supply chains.

Smart contracts: Use smart contracts to automate business logic, reducing the need for intermediaries.

Supply chain mapping: Visualize and map complex supply chains to identify bottlenecks and areas for improvement.

Risk Management

Despite these efforts, companies must still manage risks associated with cryptocurrency transactions. One of the primary concerns is:

Volatility: Cryptocurrency prices can fluctuate rapidly, affecting business operations and financials.

Security breaches: Protect sensitive data and assets from cyber threats.

Regulatory uncertainty: Navigate complex regulatory environments and avoid potential fines.

To mitigate these risks, companies must adopt robust risk management strategies:

Diversification: Spread investments across multiple cryptocurrencies and asset classes to minimize exposure.

Thorough due diligence: Conduct thorough research on cryptocurrency providers and use cases before investing.

Regular audits and monitoring: Continuously monitor financials and supply chain performance to detect potential issues.

Conclusion

Navigating the complex web of cryptocurrencies requires a holistic approach that incorporates supply chain optimization, risk management, and blockchain technology. By embracing these strategies, businesses can ensure secure and efficient trading practices, ultimately enhancing their competitiveness in today's digital economy.